Solution for cash circulation management

Cash Management.iQ helps...

- Know real-time information on cash amounts in bank branches, vaults, ATMs, and other self-service devices

- Monitor currency and denomination balances

- Predict ATM cash shortages or overflows and view cash points on a map with status updates

- Calculate the optimal replenishment frequency for objects to reduce the costs for unnecessary cash collections

- Manage cash orders by currency and denomination for an appropriate cash mix at each location

- Control cash balances to maintain adequate levels at all times

- Monitor debit and credit transactions in cash settlement centers

- Keep a log of events and provide reports for each cash point

- Perform cash management duties, including preparing receipts and expenditure documents, carrying out operations with evening cash, and keeping track of old cash

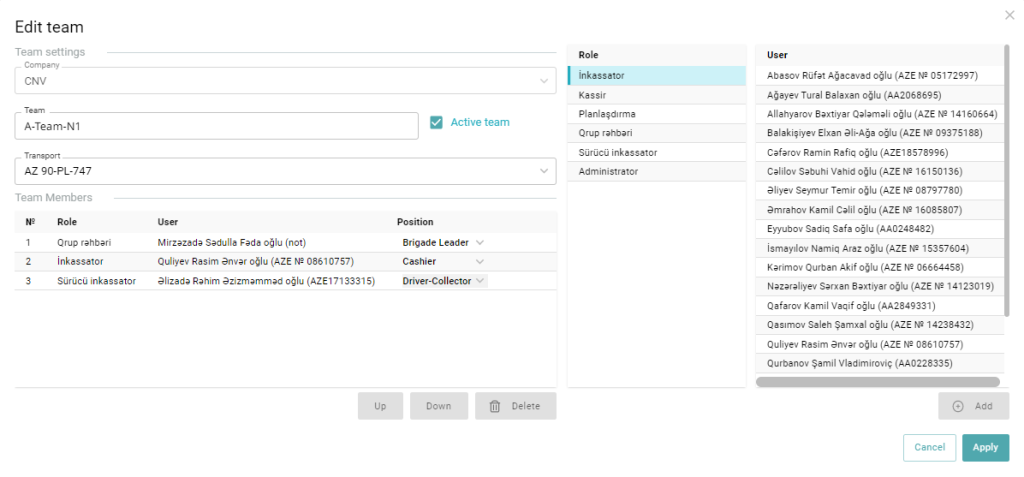

- Assemble teams for cash collection services

- Optimize routes, reducing the time and resources required for collections

- Control order execution, identify cash collection costs, and use mobile apps for operations

- Self-service device outage

- Technical incidents (cassettes, cash modules)

- Сash loading efficiency and CIT visit frequency

We are a reliable partner

Without Cash Management.iQ, banks could risk the challenges

- Extra cash in storage does not generate income

- Some denominations and currencies are missing

- Fraud risks are growing

- Сlients express dissatisfaction over the ATMs’ lack of cash

- Extra cash is kept in unclaimed ATMs

- The ATMs aren’t used to generate more income by offering additional services

- Unnecessary expenses on CIT operations

- Records processed manually or with primitive systems lead to time waste and errors

- Fraud potential

- It is not profitable to keep extra money in certain currencies and denominations.

- Extra currencies for denomination orders require additional cash collections

One solution for cash circulation management

Collects data on cash balances in bank vaults, branches, or ATMs

Forecasts cash demand for multiple currencies and denominations

Optimizes order volumes for each object to minimize waste and maximize cost savings

Monitors the cash collection process to mitigate operational and security risks

Analyzes cash management processes to identify opportunities for improvement

Produce detailed reports on cash circulation performance to drive executive decision-making

The results of using Cash Management.iQ

Increased ATM network availability

Denials of cash withdrawals drop by three times

Improved business scalability

The number of cash settlement centers can be increased from 1 to 12

Enhanced collection service performance

The number of ATMs per team that are serviced grows in proportion from 6 to 40 devices

Reduced cash collection costs

The percentage of unscheduled cash collections decreases by 30%

The bank receives information about cash balances at ATMs from the processing center. The frequency of data transmission can vary, but this information is not enough for the optimal cash distribution to ATMs and CIT planning. For these purposes, TBC Bank uses Cash Management.iQ solution.

Head of Operational Support Department at TBC Bank (Georgia)

Irakli Lomidze

During the first two months of using CashPoint Monitoring.iQ, we were able to reach 25% of savings on rent of the cash. Besides, the solution allowed us to save internal resources (first of all, staff). In order to monitor and analyze cash supply chain using the Cash Management.iQ solution, one cash professional needs to work only for two hours a day.

Deputy Head of Retail Business Management Department, Basis Bank, Georgia

Levan Bukhaidze

Cash Management.iQ software solution provides us the information on cash balances in ATM’s in real time, which allows us to more accurately plan the time of cash collection and cash optimal amount by ATM’s, as well as to reduce logistics costs.

Head of Treasury Department at BasisBank (Georgia)

George Makatsaria

Case studies

Optimization of Cash Supply Chain Management at Kapital Bank

Case study of Cash Management.iQ implementation at the largest financial institution of Azerbaijan driven by extremely high cost of cash.

Show more